%20-%20Payroll%20Screen.png)

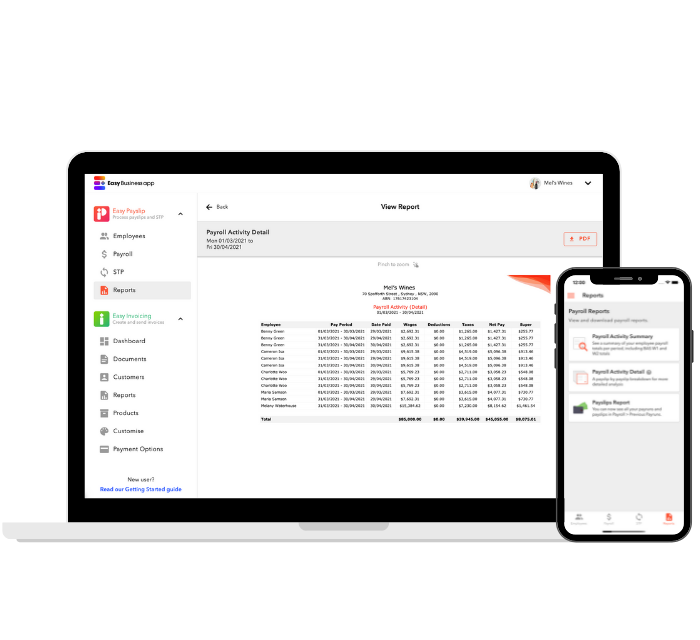

Payroll Reporting Software

There are a lot of challenges running a small business - but payroll doesn't have to be one of them.

Easy Payslip is the easiest ATO-approved payroll and STP solution for small businesses of any size, available for iOS, Android and web.

Meet all of your mandatory Australian Taxation Office (ATO) reporting requirements, and run expert payroll reports with Easy Payslip.

Our ATO approved Single Touch Payroll (STP) software and app has all of your payroll reporting requirements covered.

As well as automatically reporting your payroll details to the ATO, our smart payroll reporting software allows you the flexibility of viewing completed and previously submitted STP reports, all within a few simple clicks.

.jpg?width=350&height=438&name=SMB%20Hero%20Group%20Chat%20Notification%20POSTS%20(21).jpg)

Quickly and easily track employee salary, tax and super information with Easy Payslip’s smart reports.

Our payroll reports include both summary and detailed activity and BAS Return W1 and W2 totals. Simply choose the report you need, enter the dates, and your report is displayed — making payroll reporting easier than ever.

What’s more, all of our reporting functions are available with each pricing plan. Keen to learn more about Easy Payslip’s great features or how our payroll reporting software can benefit your small business? Get in touch today!

Try Easy Payslip for Free

Join the 10,000+ Australian businesses already using Easy Business App.

Get started today with a 30-day trial.

Frequently Asked Questions

What are the benefits of using payroll reporting software?

There are numerous benefits that come with using payroll reporting software. Payroll reporting software takes the complication out of payroll processing, saving you the time and stress that comes with manual data entry, complex spreadsheets, and separate systems. An efficient payroll reporting software will allow you to manage all of your payroll functions and handle all of your reporting requirements in one handy place.

Other uses of our compliant payroll reporting software include allowing you to meet your ATO reporting requirements, creating smart payroll reports, and effortless organisation of multiple client accounts. Additionally, these reports allow you to easily track and view employee tax, view salary information, and will even calculate BAS totals for you.

What types of payroll reports are available in Easy Payslip?

With our Payroll Activity Summary report you can quickly see totals of wages, deductions, taxes, super and net pay for each employee over the period. This payroll report also shows you your W1 and W2 BAS / IAS values.

The Payroll Detail report shows a breakdown of each individual payslip for each employee over the period - again showing wages, deductions, taxes, super and net pay.

Our Payslips report lets you drill-down into each individual payslip and see all line items individually on the payslip PDF the employee receives.

.png?width=812&height=188&name=Easy-Business-app-(colour).png)

.png)